Oct 3, 2022

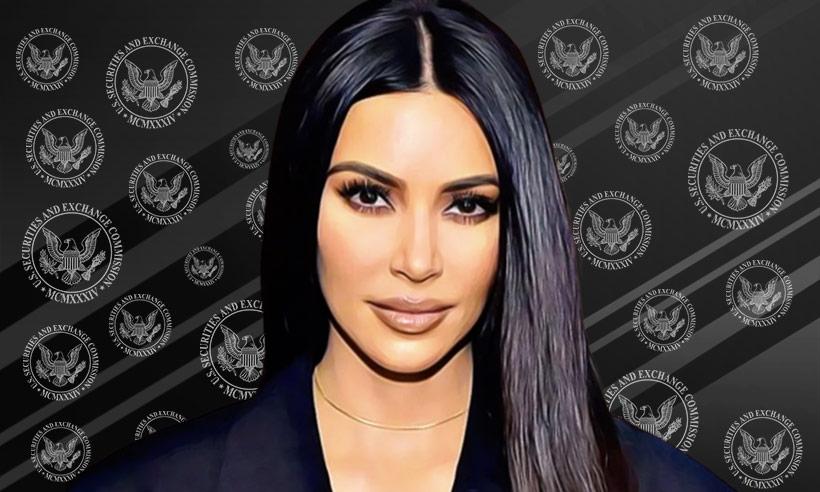

Kim Kardashian Faces SEC Charges, Illegally Promoted Crypto Securities

.

Disclaimer: The views and opinions expressed in this article are for informational purposes only and do not constitute financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Gungun is an enthusiastic writer that likes to create content for various aspects of the blockchain and crypto industry. She carries out extensive research and provides readers with informative and high-quality material.