Feb 28, 2020

by Javeria

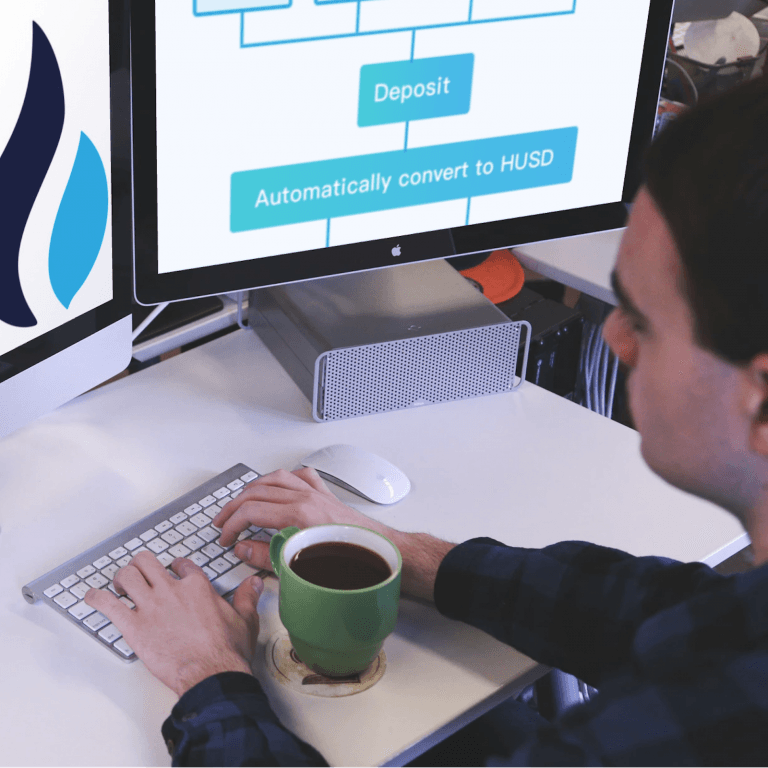

Another $1.3 Million HUSD Minted By Huobi Exchange

.

Disclaimer: The views and opinions expressed in this article are for informational purposes only and do not constitute financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Javeria is into the crypto world ever since she heard about it and is pursuing her interest through cryptoknowmics. She is a sensational poet, technical writer and content strategist. Not to mention that she can go crazy when it comes to vampires and Wonder woman.