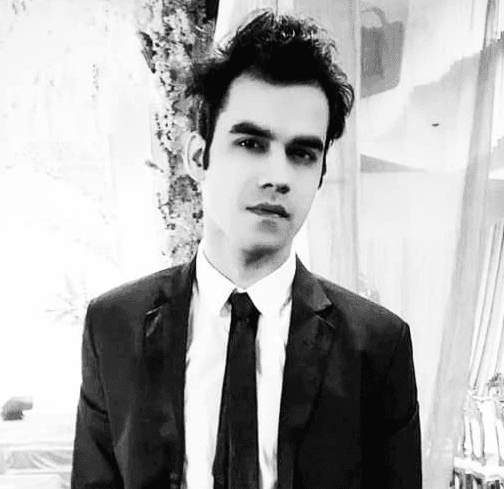

Anthony Pompliano Lashes Out at The ETH Community

“The issue is that Ether is no different than fiat currency. Fiat currencies have (a) no fixed supply, (b) an inflationary supply schedule, and (c) monetary policy decisions that are decided by a small group of individuals.”

He highlights that the monetary policy of ETH is founded on regular issuance of the asset, which is unlike digital currency. This feature makes it similar to the US dollar who gets pumped in the economy frequently.

Anthony Pompliano stated that bearing all these things in mind; Ether defeats the purpose of being used as a store of value either. While agreeing that while the supply schedule definitely reduces the issuance rate, there’s a drawback to it too as it can be increased anytime too, just like the US dollar, where the money makers increase or decrease the system’s money flow as they wish.

Anthony Pompliano Has Always Been on The Bitcoin Bandwagon

Anthony Pompliano is a staunch believer that only Bitcoin and Gold possess the needed characteristics of being used as money and as a store of value too, citing their limited supply as their biggest reason why they can pull it off. Bitcoin’s supply is limited to a fixed 21 million, out of which 17 million have been mined, and there’s no way to increase that amount. Likewise, Gold being non-renewable has a finite supply too.

While Bashing the Ethereum community and calling it more volatile than Bitcoin ever was or would be, he did praise Ether for a few peculiar attributes. Anthony Pompliano is a verified bitcoin bull and has displayed his unwavering faith in the top cryptocurrency a plethora of time.