DeFi Ecosystem

Table of contents

Image Credits: https://twitter.com/CryptoDiffer/status/1285973917480476674

Quick Takeaways

About DeFi

Decentralized Finance (DeFi), also known as Open Finance, represents a broad category of financial applications being developed on open, decentralized networks. The objective is to build a multi-faceted financial system, native to crypto that recreates and improves upon the legacy financial system. We have highlighted a few important projects, which we will explore further throughout this report, however, the list is not exhaustive for each category. The total market capitalization held by DeFi tokens is close to $6.7 bn i.e. 2.3% of the total market cap.

As the previous Bitcoin Halvings marked a beginning of a surge in Bitcoin prices and volume, expectations from the 3rd halving were set in a similar direction but none of them proved to be true even after a 5x growth in blockchain wallets from 9 mn in 2016 to 42 mn+ in 2019. Multiple narratives have taken the blame for this muted price movement. However, one phenomenon which has kept the price of Bitcoin from further falling in the DeFi explosion.

The growth of DeFi as of late can largely be attributed to two trends: support of blockchain-based finance projects by crypto exchange Coinbase which is colloquially known as “CoinBase effect” and the launches of two new DeFi coins, Compound (COMP) [Market Cap: $407 mil] and Balancer (BAL) [ Market Cap: $73 mil].

On Jun. 10, Coinbase revealed that it is looking into supporting 18 cryptocurrencies. Although the company does this every few months, this time, a sizable percentage of the tokens the exchange identified are DeFi centric. LEND, Bancor (BNT), COMP, Keep Network (KEEP), Ren (REN), and Synthetix (SNX), which were mentioned by Coinbase on Jun. 10, are either largely focused or entirely focused on enabling decentralized finance.

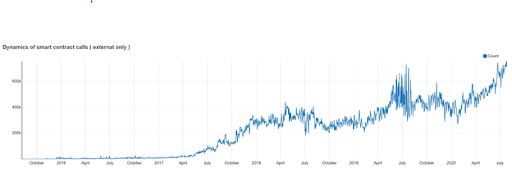

This was just the triggering event that caused the ongoing Bull Run in DeFi projects. But these projects have been gaining momentum for more than a year. The total value locked in DeFi has increased from $470 mn in July 2019 to $3.6 bn in July 2020 i.e. a whopping ~5.5x growth. The chart below from an analytics source Bloxy narrates the story of growth in monthly smart contracts spending on gas. The total spending is at an ATH.

Why is DeFi growing at such a rapid pace?

The total value locked in DeFi is close to $ 4 bn. This rapid growth of interest in DeFi projects is due for a long time. The value addition it brings to the users eliminates the limitations of the traditional platforms. The average Non-Performing Loans for 2018 based on 125 countries was 6.79 %. The highest value was in San Marino: 53.02 %. A single point of failure, lack of transparency in financial institutions has made the financial industry exposed to defaults, fraudulent activities. Smart contracts on the other hand use technology to execute all transactions and govern them as per the set rules without the discretion of any single authority.

Moreover, fiat currency is susceptible to inflations which result in depreciation in the value of personal savings. For evidence, remind yourself of the numerous scams and frauds in the history of fiat systems, including the devastating 2008 market crash.

DeFi aims to solve these issues. With the numerous high profile hacks and trust issues experienced over the years, DeFi gives users an alternative solution by eliminating the need to trust a third party at all.

The potential benefits of using DeFi applications are as follows:

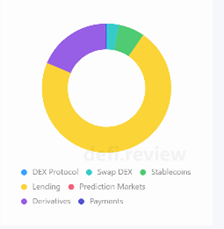

DeFi is making its way through multiple financial instruments. Few of them have been mentioned above. The application of DeFi includes but is limited to Decentralised exchanges, Lending & borrowing, Derivatives, Asset management, Insurance. At present, lending and borrowing occupy the highest share of the value locked in the DeFi ecosystem followed by payments. The distribution is shown here. Let’s have a look at different applications operating under the umbrella of Decentralized Finance.

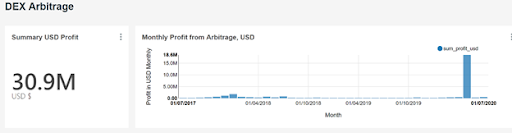

1. Decentralized Exchanges(DEX) & Protocols

As the name implies, a decentralized exchange (DEX) is a cryptocurrency exchange operating without a central authority. It is fair to assume that DEXes is one of the backbones to a DeFi Ecosystem because of its capability to trade amongst assets and provide liquidity. Relatively speaking Centralized exchanges (CEX) have much larger trade volume (USD 10.94+ trillion year-to-date) on 350+ exchanges whereas DEX has one-fifth volume (USD 2.2+ trillion). But considering the nascence of DEXs, it’s too early to conclude anything based on the numbers. Adding on to this, in the first five months of 2019, DEXes only had 705 billion in trading volume.

Here is a list of some of the DEXs operating in the economy

Yield Farming

Yield farming or Liquidity mining has been in the trend since the DeFi ecosystem started gaining momentum. In simple terms, liquidity mining is a democratized way of bringing liquidity to a protocol. The users use their assets to provide liquidity to a protocol and in return earn interest/fee. Traditionally, hedge funds or market makers have been known to provide liquidity to the protocol or exchanges but using DeFi, anyone can take advantage of offering their assets.

Here are some examples of Protocols enabling yield farming.

1. Compound Yield Farming (COMP Mining)

The compound is an automated money market protocol that can be used to lend or borrow digital assets. COMP as a token was launched by the team to enable decentralization. To boost the community growth, a liquidity mining program was launched where anyone who uses compound protocol will get COMP tokens on a pro-rata basis.

1. Curve Yield Farming (CRV)

A money market protocol for stable coins. It enables users to get the best exchange rates to get realize the value of their stable coins.

Although the concept looks lucrative and because some of these protocols provide more than 50% returns annually. But this doesn’t come without risks. As a responsible advisory platform Tradedog always recommends its users that it’s better to be informed about the risks than to be stressed. Some of the risks inherent in Liquidity Farming are as follows:

“We live in the era of Open Banking. This brave new world where customer data can be shared with almost any competitor heralds a long-term trend of better products, better prices, and better value for your money.”

– Valeria Gallo, FinTech expert in Deloitte’s EMEA Centre for Regulatory Strategy (ECRS

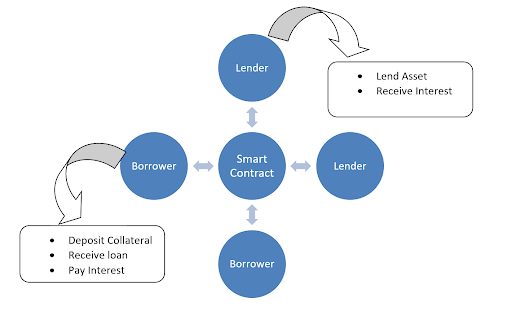

1. DeFi lending & borrowing

DeFi lending and borrowing platforms let users supply and lock their funds into smart contracts from where other users can borrow and pay interest on them. Each loan is collateralized by crypto. These protocols aim to replace financial intermediaries such as centralized exchanges and banks by building P2P lending platforms using smart contracts.

Similar to a bank, these platforms take assets from users and allow them to earn interest by lending them to the borrowers. The system is built on a blockchain (for now Ethereum is used) anyone with a chain address can access credit without redundant process.

4.68%

The spread between the lending and borrowing rates is where the project earns the fee for its platform. The maker doesn’t allow lending or borrowing of any other coin except for USD. As of 28th July 2020, MKR has the highest value locked ($1.1 bn) followed by Compound ($791 mn) and Aave($371 mn). One of the important reasons for this difference is the high-interest rates charged by Aave. If we further analyze the interest rates, the rates are determined by the set codes in the smart contract, depending on two main factors: the amount of demand to borrow the asset and the amount of asset supplied.

Let’s understand three of these protocols in brief details

1. Compound

It has established itself as a dominant money market projects over the past year. With an objective to build an open-source and decentralized protocol, it enables users to earn interest on Ethereum digital assets by lending them for acquiring real-world assets like real estate, vehicles, or commodities. It is backed by some known investors in the traditional and crypto ecosystem like a16z, Coinbase ventures, and Bain Capital Ventures. Compound raised $8.2 Mn in seed funding and $25 mn in Series A making it one of the largest venture capital investments in a DeFi start-up.

Users can supply assets to the protocol and earn interest, or borrow from protocol and pay interest. The interest rates are floating adjusting according to the market conditions.

2. Dharma

It is a platform for building lending products on Ethereum. It does not have its own token and uses DAI or USDC for transactions. Dharma Lever is one of these products and provides instant margin loans for traders. It facilitates peer-to-peer crypto lending by allowing two parties of a loan to be discoverable. Offers users the ability to borrow and lend crypto assets directly from their personal wallets (hardware, hosted, or otherwise). Borrowers can customize their desired loan terms, including asset type, collateral, and duration. Once they trustless lock up collateral in a smart contract, they receive the principal instantly. Lenders set a risk profile by specifying their desired loan terms.

Funds are held in a non-custodial wallet and continuously earn interest on all deposited assets.

Its easy access, simplicity, high security, and Fiat gateway makes it a go-to platform for nontechnical traders to participate in the DeFi ecosystem.

3. MakerDao

Collateralized loans in the crypto markets are not a new concept but the volatility of the market created a substantial difference between the sum borrowed and the sum paid back.

This is the problem MakerDao solves by combining loans with a stable coin DAI.

How does it work?

It works on a protocol allowing anyone with ETH and a MetaMask wallet to borrow money in the form of a stablecoin DAI. At the time of payback, borrowers simply pay back the loan along with the fees.

Fact: MakerDAO has been the most widely used and one of the longest-running projects in Ethereum’s Decentralized Finance (DeFi) ecosystem. To date, they have about 2.3M ETH locked in their protocol, which is over 2% of the total ETH supply.

DAI, ETH, and MKR work as an automatic system of checks and balances – each functioning to counteract the other and keep the system stable and decentralized. MKR token holders make key decisions on the operation and future of the system. The burn and creation of MKR is dependent on the stability of DAI which is pegged to 1 USD. If DAI fluctuates too far from the one-dollar peg, more MKR is created, increasing the total supply.

3. Others

There are many other DeFi solutions being developed, such as prediction markets, insurance, and DeFi infrastructure. Nexus Mutual is a decentralized insurance platform that lets users buy and sell insurance on DeFi risks.

Is it just a Speculation Mania?

With the price surge tokens in the DeFi industry are experiencing, financial industry participants have started raising questions like Is the DeFi sector another bubble? Is it mimicking the 2017 ICO bubble?

But this isn’t as simple a question as it seems. As Mati Greenspan, the founder of Quantum Economics, told Cointelegraph in an interview: “Bubbles often occur in financial markets, but the thing is: when you’re in one, it’s very difficult to tell if it’s about to pop or just get bigger.”

“It seems like it is undergoing some kind of surge in price akin to the speculative bubble in Bitcoin around 2013,” Jeremy Cheah, an associate professor at the business school of Nottingham Trent University in the United Kingdom says. He showed his belief in this alternative form of currency and added: “Blockchain is here to stay. Short-run disruptions are to be expected, but its trend is upward given the benefits of blockchain.”

The speculative craze in Bitcoin back in 2017 was different than what’s happening with DeFi today. Back in 2017, large investors were just buying the coin because the price was rising and for the same reason the price surge didn’t sustain. But DeFi is all set to disrupt the traditional borrowing and lending/investing market, which is massive in size. It is quite certain that DeFi will be at the forefront of cryptocurrency adoption and use cases. The important question is not about its certainty but how much of a share will DeFi bite and how long will it take?”

Another argument for calling it a bubble, market experts say that in the last few days the total value locked in DeFi has grown by more than 80%+. But if put things into perspective, the e-commerce market grew from $1bn to $25bn in a duration of 3 years from 1997 to 2000. When the product is innovative, it is bound to disrupt the market.

There are many more use cases in the DeFi ecosystem some of which are nascent and have high upside potential. But DEXs and credit platforms have started gaining market share at a rapid pace. Although it is too early to say whether the DeFi projects will sustain this adoption and prices but the lending industry is bound to succeed in any financial ecosystem. Considering the high profitability and centralization of the traditional lending industry, DeFi projects a target market size of $7929 billion (expected by 2023).

Tradedog’s Investment Analysis

In the last three months, DeFi projects have more than quadrupled and everyone wants to get on the ship as soon as they can. Let’s take a step back to analyze the investment proposition for DeFi projects. Portfolio Investments is a strategy that not only hedges the risk by diversifying the invested money but also provides an opportunity for the investor to take advantage of the upside potential of multiple projects with the limited invested amount. Here’s a correlation matrix of Bitcoin, Ethereum and the trending DeFi tokens. Bitcoin holds the highest market share along with Ethereum being in the top 10. Looking at the numbers above it is quite clear that the top 4 DeFi projects have a negative correlation with Bitcoin and Ethereum. This makes them an attractive investment opportunity to diversify the crypto portfolio. The positive but very low correlation of Defi projects with each other adds on to the argument that how they can constitute a risk hedged portfolio in the bull times but in the times of falling prices, the effect would be multiplied.

Decentralized exchanges are still very nascent and catching up rapidly to the CEXs. This presents a huge opportunity to invest in DEXs tokens but the volume and order books of these exchanges need to be analyzed.