Want To Stop Losing Your Money? Diversify Cryptocurrency Portfolio!

What Does “Diversify Cryptocurrency Portfolio” Mean?

Diversification can be quoted as “ To be Jack of all trades, master of none”. It means you need not to master all the exchanges and every crypto coin but have the knowledge of few of the best coins to diversify your portfolio. Let us try to understand in the simple words. Crypto Portfolio represents the varied collection of the investments that you have across all the exchanges. For instance, if you own 12 types of coins and tokens, then your portfolio is made of 10 cryptocurrencies. Now comes the portfolio diversification. Why do we need to invest in a variety of crypto assets? Naturally, to stabilize the effects of the markets and fetching the benefits from the investment.

Why Diversify Cryptocurrency Portfolio?

As per the famous quote, it has been suggested that you must not put all your eggs in one basket because if your basket fell, you might lose all your eggs. Similarly, in the crypto markets, investing in a single coin will expose you to the high level of risks which might exhaust all your funds. Thereby, diversification of portfolio is recommended for accomplishing your financial goals via crypto investments. Following reasons may clear your doubts related to why diversify cryptocurrency portfolio?

Thus, more variety of coins in your portfolio, higher the chances of exceptional returns. So, just start thinking to diversify cryptocurrency portfolio.

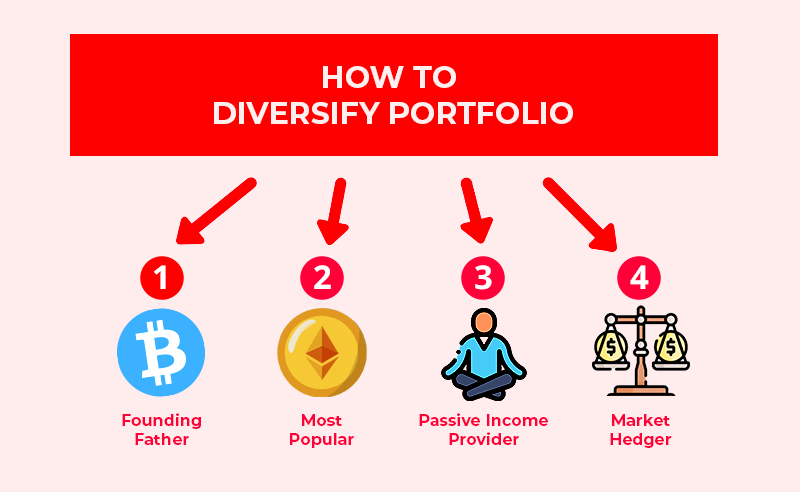

How To Diversify My Portfolio?

You might be accepting the truth that diversifying your portfolio is a necessity of the crypto markets. Are you thinking- “how to diversify my portfolio?”

Diversification of crypto portfolios is an art that must be known before putting your money into crypto space. There are considerable approaches which can be followed while expanding your bitcoin portfolio:

Sticking on the one level is not always recommended to diversify cryptocurrency portfolio. You must continuously upgrade your portfolio as per the changes in crypto markets. Rebalancing a portfolio must be a regular exercise to increase the outputs of your investments.

Portfolio Diversification Strategy

Cryptocurrency investment strategies have the potential to downgrade your portfolio, if not adequately planned. Investing without thoughtful planning, only known as gambling. Many of the crypto traders may argue that due to the volatile nature of the market, no proper strategy can be followed. But Hold On! Do you believe that we do not have any available and appropriate portfolio diversification strategy?

One basic rule or strategy can be kept in mind while expanding your portfolio: Basket of coins must have a selected number of altcoins along with stablecoins like Tether to counterbalance the risks associated with crypto markets. A portfolio with a stable collection of coins and tokens could aid the holders to survive in the bad times and outshine in good times.

Some coins, like the founding father of crypto,i.e. Bitcoin, must have some percentage of a portfolio as any trend in the market is initiated by BTC. One of the most popular coins, Ethereum can be used as base currency along with BTC, which can sustain you during the time of crisis while stabilizing your portfolio. Passive income providers or coins and tokens which are being distributed for free by airdrops and hard forks (check the authentication!) could also be added to portfolios (like Stellar, Bankera, NEO etc.). Most importantly, market hedger of the crypto markets, stablecoins are the must-have while you diversify cryptocurrency portfolio. Stablecoins like Pax, TrueUSD, USDC, Tether etc. which are backed by fiat currencies can armour you from the dreadful changes in the market. Stablecoins assures the protection from volatility while providing the needed liquidity.

There are around 5000 coins and tokens available in the crypto space with varying characteristics holding the different prospects, and you need to choose amongst them to diversify cryptocurrency portfolio. Having a balanced portfolio with a sorted strategy can save your time and money.

Stop Thinking! Start Diversifying!

Best Cryptocurrency portfolio can be a misnomer as it changes with the situation and conditions of the exchanges, tokens, coins and also affected by the regulations and protocols of the nation’s government. But it can be stated that portfolio which held the variety like that of tokens, coins, freebies and stablecoins can be considered as the best one because of its potential of hedging the loses.

If you are a newbie or want to diversify your cryptocurrency portfolio, you need not worry. Various management apps like DeltaPortfolio, Block Folio, Coin Tracking, CryptoCompare etc. are available in the crypto space, which can help you in tracking the progress of various coins and managing your portfolio accordingly. Also, portfolio managers who are financial professionals and analyze the charts related to crypto markets daily can be consulted either if you want to diversify on an institutional or individual basis.

Thus, it is recommended to stop losing money and start to diversify cryptocurrency portfolio.

Articles You May Read