Lite Report on MakerDao

Rating- TD+

BUY and HODL

Maker Statistics

(Aug 30, 2020)

(Jan 18, 2018)

(Jan 30, 2017)

Project Overview:

MakerDAO is a volatility minimisation system that uses the concept of collateralized debt obligation (CDO). In MakerDAO, CDO is known as collateralized debt positions (CDP). In simple words, it is a decentralized protocol built on Ethereum blockchain to facilitate lending and borrowing of cryptocurrencies in trustless, censorship-resistant, permissionless, open-source, and less risky manner. It is part of the “Defi'' movement-a catch-all term for financial tools and services that do not rely on centralized parties to coordinate and monitor access. It is an open-source project on the Ethereum blockchain and a Decentralized Autonomous Organization created in 2014. The smart contract operates on two currencies - Maker (MKR) that is the governance token and DAI which is used as the stable coin. The project is managed globally by people who hold its governance token, ‘MKR’. Through a system of scientific governance involving Executive Voting and Governance Polling, MKR holders manage the Maker Protocol and the financial risks of DAI to ensure its stability, transparency, and efficiency. MKR voting weight is proportional to the amount of MKR a voter stakes in the voting contract, DSChief. In other words, the more MKR tokens locked in the contract, the greater the voter’s decision-making power. MKR, the governance token affects how the network develops, while DAI is crypto collateral backed stablecoin pegged to 1 USD and it is used for payments, savings, and collateral.

The project was started in 2015 and did not conduct an ICO, instead choosing to privately sell MKR tokens to fund development over time. Maker’s DAI stable coin launched in 2018 and has gained a lot of traction.

MakerDAO, the creator of “the world’s first unbiased currency” DAI, enjoyed a first-mover advantage in the burgeoning DeFi market with the TVL at $1.42 bn (~20% dominance in the DeFi ecosystem)

Overview of MakerDAO ecosystem

In entirety, the Maker system is a circular flow of DAI, the protocol creates a balance sheet where there are borrowers (Vault Creators), lenders (DAI holders) and voters/shareholders (MKR Holders). MKR holders assume profit/losses to maintain the stability of DAI coins.

Main Actors in MakerDAO

MakerDAO protocol is executed by three main actors and two additional intermediaries.

MKR Holders

MKR is a governance token which gives the owner the rights to vote akin to a company’s shareholders. MKR holders government the mechanism holds the power to vote on the changes concerning changes in stability fee, DAI Saving rates (DSR) types of collateral accepted etc. MKR holders partake in profits and losses of the protocol. In case of under collateralized loans, MKR is minted and sold to re-collateralize the whole system. This dilutes the holders, thus passing on any losses. This ensures price stabilization of DAI by enough collateral backing. On the other hand, in case of liquidation, stability fees, penalty fee recovered from auctioning the collateral, is passed to the MKR holders apart from the DSR will be passed to the MKR holders.

Vault Creators

Borrowers or collateral depositors create the vaults and borrow DAI. Now a borrower can use the received DAI to purchase additional collateral and place it in their vaults to increase collateralization ratio. This gives a leveraged exposure in collateral to the borrower.

DAI holders

DAI holders are effectively lenders who purchase DAI from vault creators. DAI holders bear the risk of default, even though the mechanism of MakerDAO passes on the losses from under collateralization to the MKR holders. Prima facie On face value it may look like the risk to DAI holders is limited, but in the case of an event where system losses are so huge that MKR holders are unable to absorb them (i.e MKR prices depreciates to 0), then the DAI’s value will also decline as the system will become under collateralized.

Apart from the above, actors/participants of the Maker protocol, Price Oracles and Keepers also play an important role in its ecosystem.

Price Oracles

Their primary function is to feed the market value of different tokens (including collateral, MKR, etc). The maker uses the median of these price feeds to determine the collateral prices and evaluate Collateralization Ratio of the vaults.

Due to the risk of an oracle attack where an attacker can potentially compromise the oracles and feed false price information to manipulate, then collateral prices in the protocol, Maker updates the prices every hour or at +/-1% move. This allows MKR governance to freeze the protocol in the event of an attack.

Keepers

Automated parties that facilitate essential functions in the protocol to maintain stability are called Keepers. Market Makers and Auction Keepers are the two main types of keepers in the protocol. Market Maker keepers buy/sell DAI to maintain the stability peg and are incentivized by the high likelihood of profits on their trades.

Auction Keepers bid on collateral in the event of under collateralization. They are incentivized to bid on auctions and buy collateral at a discount.

Use Cases:

Maker’s protocol allows you to create DAI stablecoins by locking up your collateral (ETH, BAT) in the smart contract of the platform.These types of contracts were created by Maker in 2014 and they are called Collateralized Debt Positions, or CDP.

To open CDP and mint DAI, users need to lock at least 150% more collateral on the Maker contract. This is the minimum ratio that has to be maintained and is known as Collateralization Ratio. When the collateralized ration falls below 150%, the collateral position will get liquidated and will be sold at a discount on the open market, resulting in losses to the issuer of the CDP.

Governance of Protocol:

Before March 25, 2015, Maker foundation used to govern the smart contracts of MakerDao. However, they recently announced that it has transferred full control of the contract to the Maker governance community. Maker uses an on-chain voting mechanism to vote for the protocol on important governance decisions. To participate in voting, users have to own the governance token - MKR. The voting rights of the user will depend on the number of tokens held

All the fees are paid in DAI. Fees collected are not transferred to MKR holders, instead, it is transferred to Maker buffer. Maker buffer acts as a hedge against a potential increase in MKR supply. If the buffer limit exceeds, the surplus is sold through a surplus auction. Bidders compete by bidding decreasing amounts of MKR to receive a fixed amount of DAI. When an auction ends, all the MKR collected is autonomously destroyed. Reduction in supply positively impacts the MKR price

MakerDao Ecosystem:

MakerDao is presently standing in the top 2 DeFi platform along with Aave, with 3.7mn ETH locked in its smart contracts, equivalent to $1.44bn. It is traded on more than 15 exchanges, including Coinbase Pro, Kraken and Bitfinex with total 24h volume of more than $37M and a total market cap of $629M, according to Coinmarketcap. MKR is used on some of the most popular Defi exchanges including Uniswap, Compound, dydx and few others. DAI is particularly important in terms of Defi space as they aim to fully decentralize their operations. DAI can also be borrowed and lent through various P2P lending sites. All big players, both centralized and decentralized embrace it. MKR enjoys an edge over other blockchain apps (not only Defi) and shows strong signs of real growth, which most other blockchain dapps lacks.

Investments

MakerDAO ecosystem was the first to bring a decentralised stablecoin in the blockchain industry. The innovation attracted some very well known funds around the world to invest in the project.

Partnerships

As long as the project continues to expand its ecosystem, and as the overall Defi market continues to grow, Maker is most likely to dominate the space.

SWOT Analysis

Strength –

Weakness

Risk of DAI Stability

Although DAI is an effective stable coin but has weaker price stability compared to traditional stable coins. The 24-hour volume of DAI is $47mn as compared to USDT which stands at $33bn.

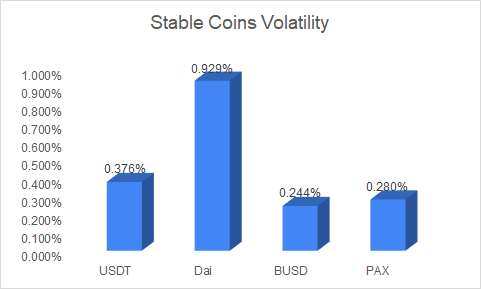

The data clearly shows that DAI has volatility of close to 1% whereas the other centralised stable coins have a volatility of less than 0.5%. This pegging risk to DAI makes its scalability difficult.

Updates

28 Aug. MANA Approved by Maker Governance as Collateral Type in the Maker Protocol. As a result of an Executive Vote that ended today, MKR holders have accepted MANA (Decentraland) as a new collateral asset in the Maker Protocol. The token can now be used to open Maker Vaults in order to generate Dai.

27 Aug: The First Maker Foundation Internal Hackathon held in June Produces Great New Solutions for Dai

9 July. MakerDAO Approves 4 New Light Feeds For Oracles. To increase the security of the Protocol as MakerDAO moves toward complete decentralization, Maker Governance recently reviewed and discussed Maker Improvement Proposals (MIPs) to add four “Light” Feeds to the existing Oracle group:

2 July. Maker Foundation Offers a 25,000 Dai Prize to Winner(s) of Reddit/Ethereum Scaling Competition to help stimulate engagement and incentivize great proposals, the Maker Foundation has decided to offer a 25,000 Dai bounty to the victorious developer (or dev team). The vision is that every Reddit community (subreddit) will create their own customized Points and decide how they will be used. So, there’s an incredible opportunity for the competition to result in a wide range of applications offering a broad spectrum of benefits.

June 9, MKR began trading on Coinbase Pro.

4 June. TUSD and USDC-B Approved by Maker Governance as Collateral Types in the Maker Protocol

May 4. MakerDAO Takes New Measures to Prevent Another ‘Black Swan’ Collapse. The DeFi lending market MakerDAO has updated its governance protocols to prevent another occurrence of forced liquidations that lead to huge losses.

May 3. Wrapped BTC (WBTC) now an accepted collateral asset in MakerDAO

Investment Analysis

Looking at the correlation matrix, it can be inferred that Maker holds a weak correlation coefficient with other competitors and top cryptocurrencies. This makes it a good prospect for diversification in portfolio investment. However, the nascence of the DeFi market makes this conclusion a little weak. As the adoption will grow, the data points will become clearer.

Technical Analysis of MKR/USDT

Looking a lot the monthly MKR/USD chart, it is continuously trading in the range of $340 to $810. Overall, movement is sideways but it is managing to hold onto the 20 - Monthly EMA which is at $510. Major support levels are present at $290-$300 while the nearest major resistance is placed at $790-$810.

As per the weekly chart, it has a trading range of $440 to $800.Overall, the trend is sideways but it is managing to hold its 60-WEMA which is placed at $475. Last two weekly candles are bearish and show lack of direction. If this week’s candle closes below $590, then technicals would suggest we can expect further downside momentum to continue to the level of $450-$430.

As per the daily chart, the trend is positive as it is trading above its medium and larger DEMA’s. It is also witnessing higher tops and higher lows kind of formation which indicates positive movement in coming trading sessions. The main hurdle is placed at $800, if it manages to close above $800 decisively, we can see the levels of 1200$ in the coming sessions.

Conclusion

In conclusion, MakerDao is a novel and innovative protocol that allows for on-chain collateralized borrowing, while also creating a reasonably effective stablecoin. The team is led by Rune Christensen and is well equipped with experience and expertise. Although Maker is decentralised in nature 87% of the total supply is held in top 100 wallets which does not make the case of decentralisation very strong. But this is not a Maker specific issue. This issue is an industry challenge which exists because of the nascency. From the development perspective, MKR holders continue to make iterative improvements to the protocol. As per the combined data, MKR/USD is in sideways movement. We would therefore advise traders to buy only if it manages to close above $800 on a daily basis with the stop loss of $570 and the first target of $1200, followed by $1800.

If you already have a position then try to accumulate in the range of $300-$350, and hold for the upside target. Putting all things in a perspective, Tradedog recommends a BUY and HODL for MakerDAO. DeFi ecosystem is growing at an exponential pace. Maker is presently standing in the top 2 projects of DeFi space.