Tradedog's Review of xBTC- Industry Problems, Solutions, and Purchase Recommendation

Table of contents

Project Overview

Two prominent solutions for protecting capital investment in volatile markets such as Digital Assets are hedging and indexing. Although there are various financial instruments available that offer these features separately via options and index funds, a single financial instrument that provides the benefits of a viable hedge and a growth index fund is still not available. xBTC is a product created by Social Capital that uniquely combines both hedging and indexing in the digital asset space. Instead of hedging against Bitcoin’s price, xBTC allows holders to access a synthetic hedge against Bitcoin market cap dominance (BMCD) through a term known as “Dominance Hedge.” xBTC is a rebasing token that is pegged to BMCD. In simple words, xBTC is a synthetic hedge against Bitcoin’s dominance.

So what potential value could there be for such an instrument?

Bitcoin, as the first cryptocurrency ever created, will always be at the forefront of the decentralized ecosystem, however, as the industry evolves, new crypto projects joining this ecosystem will inevitably reduce Bitcoin’s dominance. In many ways Bitcoin is now a limited and inferior technology compared to the new innovative solutions that are being created with extremely profitable and successful value propositions. We have a current market where the combined Altcoin ecosystem boasts billions of dollars in users, hundreds of millions in profits and firm partnerships with multinational corporations. We have seen major growth in DeFi, gaming, social networks and much more. These other digital assets are changing the face of finance, commerce, business, and technology beyond imagination.

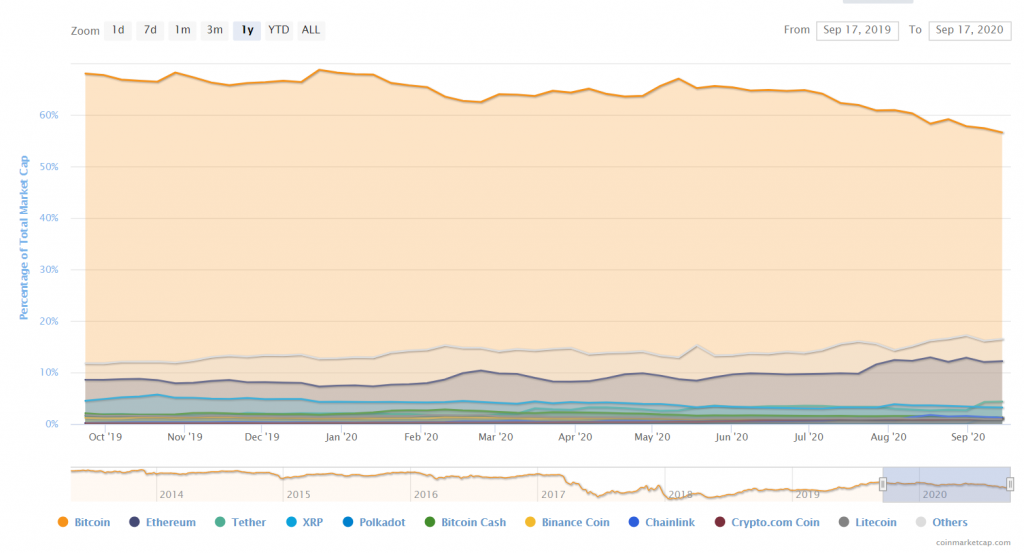

This is a primary reason why BMCD has seen continuous depreciation in the last few years and why it will likely continue. In the last bull run in 2017 Bitcoin Dominance fell to 30% and that was when many altcoins were just whitepaper and vaporware. Taking this into consideration it would stand to reason that an indexing instrument that tracks the growth in altcoin markets and at the same time provides diversification would likely provide value to savvy investors.

Bitcoin’s price is actually a very poor indicator of its true value proposition, as we have seen from its historical wild swings of 10,000% gains and 90% losses in its past history, therefore it stands to logical reason that an investment instrument created as a protective hedge has the potential to generate financial value to xBTC holders as Bitcoin’s dominance reduces.

xBTC uses the “rebasing” model to adjust the token supply of the entire market, and all holders’ wallets through pegging its price to Bitcoin’s market cap dominance (BMCD). If the dominance goes down, more supply is released to increase all wallet holdings (Positive Rebasing)that probably helps in price appreciation. If BMCD goes up, supply is extracted from holders’ wallets (Negative Rebasing) that probably causes price appreciation.

With any early stage project there are risks associated, such as the ability to grow community engagement, smart contract risks, how well the project might deal with a stretched out bear market. Another challenge might be if investors are unable to fully understand the concept of rebasing and elastic supply. However, these are systemic risks that are going to impact the whole ecosystem and in truth there will be some that will not like the concept of rebasing and others that will. In any case, it’s clear with any new form of idea it will likely take time to assess how well this will be accepted and adopted.

xBTC does not actually hold the underlying assets, it is a synthetic dominance hedge and by extension a synthetic index fund. This means it behaves like traditional derivatives, where their notional value is 600 Trillion and their real value is 12 trillion. This is a huge area of growth in digital assets and xBTC is a completely decentralized and market driven form of derivatives. This allows people to quickly and easily move out of a complex bet (betting on the dominance of every single altcoin on earth), just like traditional derivatives.

Problems

The Crypto ecosystem is fairly nascent and therefore out of the reach of most retail investors whose risk appetite is comparatively lower. The major challenges faced by investors can be divided into the following

1. Difficulty and Accessibility:

Although internet penetration around the world is nearly 59% and is growing at an accelerated pace, the technology underlying the digital assets market is difficult to understand and access. This statement can be validated by the fact that nearly 40% of the total crypto holdings are held by the top 1000 wallets.

2. Diversification:

Adding to the troubles of users, Portfolio management in Crypto assets poses a challenge as it is difficult to manage multiple assets at the same time. Diversification has proved to be a profitable strategy to avoid losses due to unsystematic risks. It benefits the users by increasing the chances of positive returns and reducing the possibility of high losses. A diversified fund like the S&P 500 outperformed 92% of actively managed funds over a period of 15 years and has consistently outperformed for decades. Lack of indices in crypto markets keeps passive investors away from the ecosystem.

3. Hedging:

Bitcoin is a highly volatile asset with wild swings of 10,000% gains and 90% losses, so essentially the market price does not reflect the true value. Therefore, a hedge against the price doesn’t prove to be a good trading strategy.

Solution

xBTC aims to solve these challenges with its revolutionary protocol that brings both hedging and index funds to the digital asset space in a unique and synthetic way. xBTC allows holders to hedge against BMCD (Dominance hedge) therefore creating increased value with the market growth in altcoins. In summary, xBTC is a single token that provides investors synthetic access to nearly the most diversified portfolio possible; thus reducing individual altcoin unsystematic risk. With a vision to build the most diversified synthetic and passive index fund in digital assets, xBTC is on a mission to revolutionize finance. To achieve this inclusive mission, xBTC primarily offers 5 key features.

1. Synthetic Dominance hedge against Bitcoin

Earlier we mentioned about the challenges of a hedging instrument against the price of an asset that is highly volatile such as Bitcoin. To solve this problem, xBTC has come up with a unique solution where the token is hedged against the Bitcoin Market cap dominance. Here is the trailing 12 months chart of BMCD and it is evident from the chart that the market dominance reflects the true value proposition. Another observation from the chart is that BMCD has been gradually falling and an instrument like xBTC, hedging BMCD, can help investors to take advantage of the rising altcoins market (which we saw in 2017).

2. Synthetic Index Fund of all Digital assets

With benefits like low expense costs and diversification, passive index funds of all digital assets offer a lower risk financial instrument for investors. xBTC allows access to the dominance of every single digital asset against Bitcoin.

3. Community and Holders Rewarded

Through staking rewards and rebases, holders are rewarded for long term investing. Rewarding the community and holders builds an intrinsic value of the asset.

4. Tokenized Derivative

Primarily, xBTC is a synthetic dominance hedge and an indexing instrument, however, on a more technical and deeper layer, it can be used as the world’s first tokenized derivative. Technically, xBTC enables users to insure themselves against the fall of Bitcoin and follow the growth in altcoins. Traditionally derivatives have allowed users to hedge their positions by paying a small premium but xBTC takes this to a next level. It differentiates itself from traditional derivatives in various forms such as

Although it cannot be leveraged directly until xBTC is listed on a CEX that offers leveraged trading, it is worth noting that the working mechanism of xBTC i.e. hedging against the BMCD and using rebasing, its market cap and value could potentially far outpace the actual dollar value of swings in Bitcoin dominance, as we have seen in the notional value of derivatives in traditional markets.

Market Opportunity

As of Q2, 2020 there are 50 million crypto wallets in the world (~50% increase YoY). The total market cap of crypto assets is nearly $331 bn down from ~$900 bn in 2017. The space is now evolving and increasing. Bitcoin market dominance is nearly ~60% and with the increase in other crypto assets, BMCD is expected to fall thus increasing the utility of xBTC.

The derivative market is worth an estimated notional value of $640 trillion (some estimates go up to $1 quadrillion), with a real market value of $12 trillion. The entire S&P 500 has a market cap of $28 trillion. This means the derivatives market is ~2100% the value of the entire S&P 500. The notional value of derivatives is worth more than global wealth by over 100%.

Mechanism

xBTC uses a novel mechanism called ‘rebasing’ or adaptive supply. By changing the supply, the protocol pushes the market price of an asset towards a target price (“peg”). Traditionally this concept is more commonly known as Quantitative easing (QE). QE in various monetary systems concentrates the issuance of the currency into the accounts of few market participants, undermining the utility of the market distortions. Monetary policy has been unilateral, opaque, arbitrary and reactionary, leaving the market guessing at the whims of centralized authorities. On the contrary, transparent known supplies and issuance schedules, such as in digital commodities like Bitcoin or Ethereum, lead to complacency of the market participants in a disinflationary economy with poor velocity. Crypto currencies with a fixed supply suffer inelasticity problems and are vulnerable to sudden shocks in demand that makes denominating things harder. An adaptive supply which updates at a greater frequency and is transparent and verifiable will offer an economic system and policy that is unparalleled across societies. This is the milestone Social Capital (Parent company of xBTC aims to achieve) and their first product is a dominance hedge against Bitcoin. The goal is to reward the holders of xBTC as altcoins continue to rise and Bitcoin wanes in market dominance.

Prima facie, a decreasing target price appears to lower the value of an asset. However, elastic supply makes the pegging balanced against investors’ demand and use. As investors in XBTC increases, i.e. more people hedge against Bitcoin, a higher demand increases the prices of xBTC. The higher price will push the supply to go up through rebasing and move the price down towards the peg. So xBTC holders will get more supply. So essentially xBTC is a negative trending peg to a positive trending demand. This optimizes positive rebases, sending more supply to users, which is the primary way to benefit from a rebasing token.

Let’s Understand Rebasing

Rebasing means using adaptive supply to pressure the price in the right direction.

The BMCD is translated to a dollar value. An oracle feeds the data of Bitcoin Market dominance to the protocol, and the supply is changed to move the price towards the target price.

Let's take an example: If market cap of other assets = $200B and BMCD = $120B

This means that BMCD is 60%, thus corresponding dollar value will be $0.6.

Now, if Bitcoin’s market dominance reduces to 50% i.e. BMCD’s dollar value reduces to $0.5, i.e there will be a POSITIVE REBASE (Increase in supply leading to more xBTC tokens with the holders).

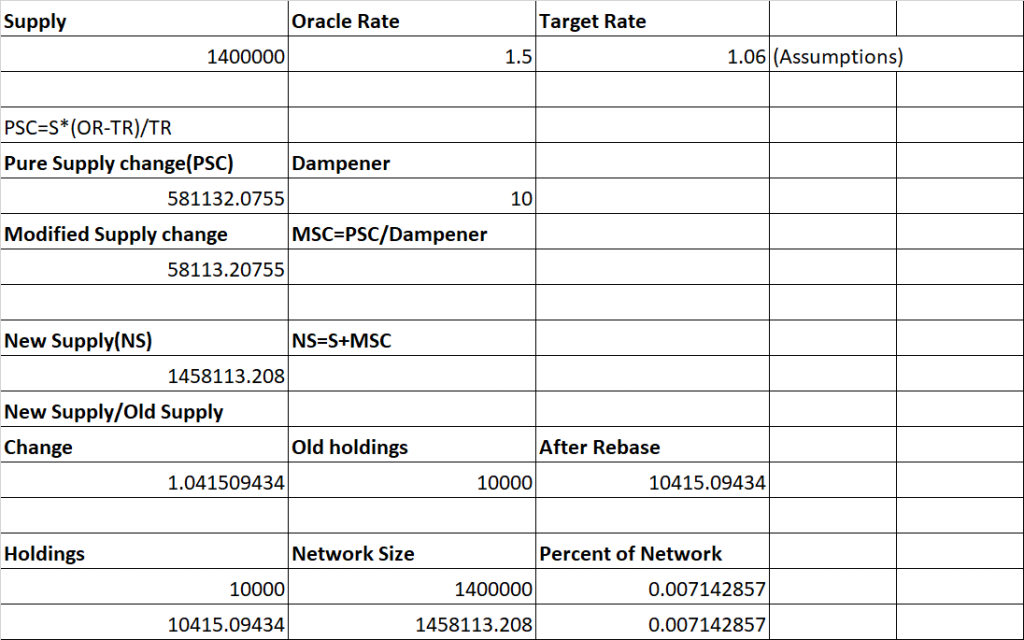

The protocol is built so as to ensure that the all holdings as a percentage of the total supply remain the same unlike in the centralised ecosystem. Below is an example of the rebasing. You can try out the rebasing simulations here. Please download the sheet on your local device and use it to calculate token rebasing.

States of the xBTC Protocol

xBTC protocol can exist in the following three states:

1. Expansion

In this state, the supply of xBTC tokens is proportionally increased across all the wallets holding xBTC tokens. Let’s go through a quick example.

A → Buys 1 xBTC for $1

Demand Increases

1 xBTC = $2 (> $1.06)

Supply increases proportionally

A → 2 xBTC = $ 2 ( 1xBTC worth of $1)

Imagine ‘A’ buys 1 xBTC for $1. As demand for xBTC suddenly increases, 1 xBTC is now worth $2 which is above our target price of $1.006. In this case, the xBTC protocol will seek a price-supply equilibrium by increasing the supply of xBTC, so ‘A’ ends up with 2 xBTC each worth $1.

2. Contraction

As expected, this is the exact opposite of the expansion state. When the system is in the contraction state the supply of xBTC tokens is proportionally decreased across all the wallets holding xBTC tokens.

A → Buys 1 xBTC for $1

Demand decreases

1 xBTC = $0.5 (< $0.97)

Supply decreases proportionally

A → 0.5 xBTC = $ 0.5 ( 1 xBTC worth of $1)

So if A buys 1 xBTC for $1 and due to a decrease in demand, the price of xBTC drops to $0.5, the system will reduce the supply of xBTC. A ends up with 0.5 xBTC worth $0.5 as the price of 1 xBTC reverts back to $1.

3. Equilibrium

The last state i.e. the ‘equilibrium’, is the only state where the algorithm doesn’t seek to increase or decrease the supply of xBTC. This is basically a state where there is no need to do anything as the current price is within range of the target price.

To avoid a scenario where the parity becomes almost impossible, the supply must be hyper responsive to positive market price conditions in order to balance exponential demand. If market price is under the target price, parity is found more easily with a natural increase in demand. Similarly, negative rebasing in an aggressive manner can cause inorganic dampening of the market therefore a cap of 10% is placed on negative rebases.

In equilibrium the rebase will not happen if the spot price is close enough to the target price. If the spot price of xBTC is less than 5% below the target price no negative rebase will happen. If the spot price of xBTC is less than 5% above the target price no positive rebase will happen. The difference between the negative and positive “peg windows” exist to create more organic market movements. A larger negative rebase can cause the negative rebase spiral. As such, having the negative rebase start quicker at a smaller amount can make the market react quicker. On the upper end, positive rebases need less corralling, as they are unlimited and do not digress so powerfully. This window allows the spot price to “float” around the target price letting the market naturally match supply and demand. Once supply and demand fall too far out of step (moving outside the peg window), rebases are employed to bring them back into balance.

Components of the protocol

1. Oracle

To peg xBTC to BMCD, an oracle is required that will feed the off chain data to the blockchain. A suitable oracle should be reliable, secure and decentralised. Initially, xBTC partnered with Tellor Network to be used for the oracle service. It uses a distributed voting system to ensure data is verified with the help of PoW and PoS algorithms. The other price required by the protocol is the xBTC price. Although this price is available on chain through Uniswap, it carries the risk of single party manipulation. To avoid this risk, the protocol uses a VWAP i.e. volume weighted average price.

Token Economics

Token economics indicates the distribution of tokens across the network participants. A good project allocates tokens to ensure incentives for all participants. xBTC has done a good job in designing the token distribution.

1. Uniswap Liquidity (10%)

These tokens will be used for providing initial liquidity on Uniswap. Once, these tokens are no longer needed for liquidity, they will be shifted to become part of ecosystem incentives and other expenses. There will be no locking or burning of these liquidity tokens as this may prove to be counterproductive for the project’s long term sustainability. Instead, these tokens will be used to support xBTC and the community for being the liquidity providers. This particular feature gives edge to xBTC over its competitors as locking or burning of tokens is a counteractive process which makes the project less efficient. xBTC’s team has committed to two things.

These measures were taken to make sure that there is no sudden change in xBTC’s price due to the change in supply. If there was no vesting period fixed, many of the shareholders could exit their position which in return could create immediate change in supply. Also, to make sure that their system runs smoothly, liquidity levels have to be maintained so that everyone can participate without any difficulty.

2. Partnerships and Marketing (5%)

Essentially, these tokens will be used directly for expanding the user base. These tokens will pay for strategic marketing and partnerships, exchange listings and other expenses in creating awareness about xBTC. As the recipients spread the word, xBTC’s community will grow. This will push the price up, and consequently supply to all holders will increase. This incentivizes community engagement. And, as compared to other projects, this focus on community growth of xBTC through partnerships shows xBTC’s long term growth and sustainability plans.

3. Ecosystem Incentives (40%)

These tokens will be used for rewarding the users that support the ecosystem. Incentives will be given to those users who help in providing liquidity or staking xBTC. As the key component of their ecosystem is liquidity so as users provide liquidity, these tokens are transferred in the mint. The Mint will then distribute xBTC to these users for supporting the ecosystem with their liquidity. This will also incentivize the holding and accumulation of xBTC for the holders. Almost 80% of their supply will be used for Mint programs, these will be publicly visible and locked in a smart contract that only allows them to be shared with liquidity providers. These can also be used to host user competitions that can benefit the ecosystem, such as code-offs and DApp build-offs.

Now, as compared to other projects like Balancer, Compound, Synthetix which only allocated limited supply like 5%, 7.75% and 1.90% respectively for their ecosystem incentives, xBTC uses 40% of their funds for this which indicates their user friendly and sustainable approach. As this project is decentralized in nature and it will be fully up to the community as to where it goes and by making it more rewarding for the community, the project can be more futuristic.

4. Team (10%)

These funds will be used for development of the ecosystem. To make any project a success, money and effort is needed and by making the job more rewarding and satisfying, more skilled people would like to join the team. This stake also aligns with their community’s incentive structure which will benefit xBTC’s users and ecosystem in the longer run.

Team tokens will be locked up for the first 6 months. At 6 months, 30% will be released to the team, and 7% will be released each month after that until fully vested. These measures are also taken to make sure that there is no abrupt change in supply which in return can make the system more prone to rebasing.

5. Public Launch (35%)

These will be distributed to the public as the first users of xBTC. Liquidity being the major challenge for any DeFi protocol, xBTC’s first priority will be to focus on building Uniswap liquidity and ensure market functions smoothly at launch. Half of team funds and all of the Uniswap funds will go into the Uniswap liquidity pool, the other half of team funds will be locked in a small contract until vesting begins.

To make sure that the project remains sustainable and rewarding for its users, xBTC created 2 ways for its users to earn. One benefit is from the change of supply from the rebasing along with the added incentives of the Mint.

Compared to other Defi projects such as Synthetix, xBTC has given better stake for public issues as Synthetix had only allotted 3% for its public issue. This shows that they want xBTC to be community driven.

Partnerships

1. xBTC and Tellor Network

In order to peg xBTC to Bitcoin market dominance, xBTC partnered withTellor Network (TLR). Tellor is the most secure and simple decentralized Oracle solution for smart contracts that need high value off-chain data. Nicholas Fett, CTO of Tellor and their team directly helped in designing the xBTC oracle. Linear Finance also took the help of TLR for building their oracles.

2. xBTC and UnificationTo make their data streams more reliable and precise, xBTC has also partnered with Unification for continuous auditing of accurate and current data streams. Unification provides rapidly deployable blockchain tools with built-in cost and speed predictability that brings security and efficiency in business operations.

3. Accelerated by TDeFi

xBTC is also supported by TradeDog TDefi accelerator program. TDefi accelerator provides access to world class mentors and provides all the resources including technology, marketing, liquidity and growth hacking partnerships.

4. Zokyo and xBTC

To make their smart contract more reliable and secure, xBTC has also partnered with Zokyo as their security partner who will audit their smart contract. PlutusDefi also recently collaborated with Zokyo for auditing their smart contract.

5. 1inch and xBTC

xBTC and 1inch have entered a strategic partnership for the public launch of xBTC’s token. xBTC will launch exclusively on 1inch’s platform, Mooniswap. Mooniswap has developed a unique solution to reduce front running and manipulation by bots. Mooniswap has total liquidity of $99 mn and 24-hour volume of $2.7 mn.

6. xBTC and Magnus Capital

Magnus capital has recently partnered with xBTC. Magnus capital helps new companies emerge to market dominance. It ultimately allows businesses access to co-investors, capital markets, business partnerships, node operators, developers and community managers. Magnus Capital has also invested in Ampleforth, Origin, Ethverse, TrustSwap, Dos Network,Quantstamp and many more projects.

Team

Every successful project, be it in a traditional space or crypto ecosystem, has one common trait. They all were backed by a strong, dedicated and committed team. A good team is a combination of right people at the right place. xBTC team fulfills all the criteria of a successful team. It comprises experienced professionals, early adopters of the blockchain ecosystem, and have a stronghold in their respective fields.

1. Mark Sgambelluri: Co-founder and CEO

2. Aatash Amir: Co-Founder and COO

3. Jonas Lindgren: CTO

4. Manny Boralessa

● Alumnus of Gonzaga University

● Worked as Sr. Product Manager for Amazon

5. Adam Grose, Creative Director

● 20+ years of experience in Graphic Design Industry

● Worked with TrustSwap, Statera

Investors and Advisors

1. Jeff Kirdeikis, CEO, TrustSwap

TrustSwap is the next evolution of Decentralized Finance (DeFi) transactions solving major problems with subscriptions, split payments, and cross-chain token swaps. A cross-chain “smart swap” system is used to wrap any token or coin (Bitcoin, Litecoin, Monero, Ripple, Cardano) into an ERC20

2. Sami Rusani, Chief Revenue Officer, ShipChain

ShipChain is making transport and logistics more effective, secure and transparent by utilizing blockchain technology.

3. Lester Lim

Lester is a veteran digital marketing entrepreneur and a leader in startup incubation. He has operated multiple million-dollar digital marketing and ecommerce businesses, and is currently one of the most sought after incubators to lead the funding rounds for blockchain startups.

4. O1ex

O1ex is a renowned family office and has previously invested in early stage ventures. They have previously invested in COTI, TOP Network. This gives an edge to XBTC to access the ecosystem support.

5. Brian D. Evans

Brian is a lifelong entrepreneur that has founded and advised multiple companies in various industries & verticals such as eCommerce, mobile apps, tech and SaaS platforms, digital publishing, blockchain, gaming, logistics, supply chain, and more. In 2015, he became an Inc. 500 Entrepreneur. His online advertising, marketing and consulting agency made the Inc. 500 list of Fastest-Growing Private Companies in America, and was one of the Top 25 Advertising and Marketing Companies in America.

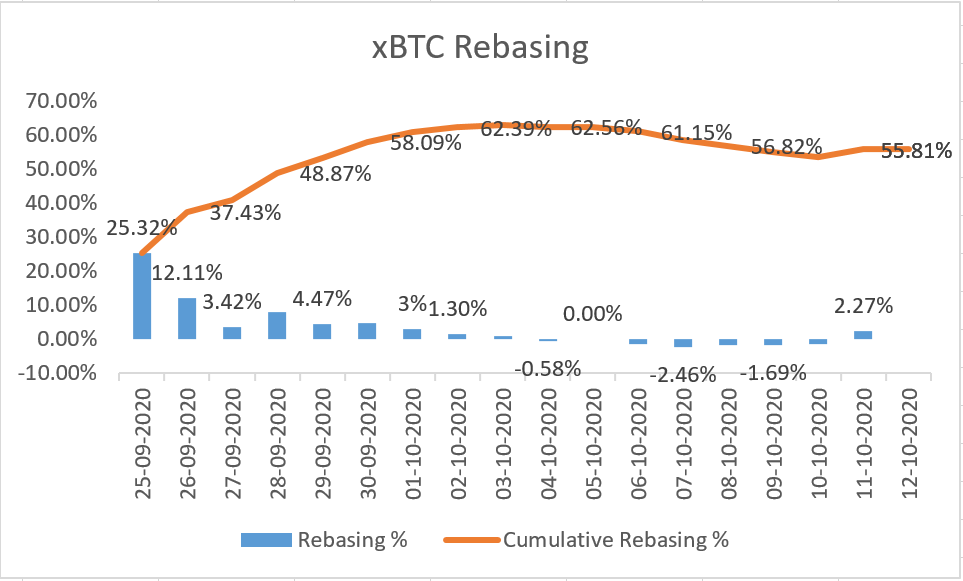

xBTC performance in IDO (Initial Dex Offering)

xBTC was listed on Mooniswap and Uniswap on 25th September. After opening at $1.3479, it made a high of $2.737, a gain of almost 100%. And, from its target price, positive rebasing of 25.32% was witnessed on the first day itself. It is experiencing positive rebasing on daily basis and in the last 17 trading sessions, it has achieved cumulative rebasing of 55.81%, meaning if you had 100 tokens of xbtc, then after rebasing you would get an additional 55.81 tokens and your total holding would be of 155.81 tokens, it shows the earning potential this project has to offer. With BMCD rising, there were some days of negative rebasing but with the altcoins catching up the rising market, the demand for the token holders increased thus reverting to positive rebasing.

Recent Updates

Conclusion

Traditionally rebasing coins like AMPL have been tracking only price. Rebasing to price is uninventive and exposes the protocol to be played around by traders. Crypto markets have high price volatility and hence prices are not the true indicators of the true value propositions. xBTC uses a novel oracle as the target peg and this solution makes it a true use case for rebasing, "synthetic assets" like derivatives, hedges, index funds, etc.

xBTC brings real world data into the economies of a token and creates some real revolutionary outcomes. All rebasing does is create economies on chain (adjusting supply and xBTC is building an economy based around bitcoin market cap dominance).

The supply and demand of an asset determines spot price. xBTC modifies the supply based on the BMCD (Bitcoin Market Cap Dominance), which means xBTC becomes reactive to BMCD. Think of it as almost a prediction market of where BMCD will go. If you think it will go down buy because you will get a positive rebase if you think it will go up sell because it will be a negative rebase. It becomes a way to quickly and easily trade against BMCD, which doesn’t currently exist. It has some analogous features to a derivative or option in a synthetic form (there is no collateral). The traditional derivative market is worth 600 trillion dollars notionally and 12 trillion in real value. It can be argued that the idea that 600 trillion in notional value actually has any backing is farfetched at best, derivatives are basically just a prediction market. Which is why one could argue xBTC is introducing. This is the first asset of its kind. It’s like sBTC from SNX or the sNikkei from them (traditional synthetic assets). SNX doesn’t actually have full collateral (they do have a fractional reserve system) the synthetic nikkei has no real connection to the real nikkei other than they force its price on their exchange. xBTC doesn’t force their price, it is decided by the market. It is a new way of conceptualizing and creating synthetic assets.

Even if the only outcome of xBTC was to put a market price on Bitcoin Market Cap Dominance, it could be revolutionary, but it does so much more. To put things into perspective, Tradedog believes that rebasing is a highly effective mechanism to build a sustainable economy and by coupling market dominance of Bitcoin, xBTC has solved a major challenge of crypto hedging instruments. xBTC is an innovation in the digital asset space and is a first of its kind as its target price is pegged to Bitcoin market cap dominance (BMCD). Basically, xBTC has presented such a unique way to hedge against Bitcoin without even shorting it as xBTC tracks the dominance of every single altcoin in the market which itself presents as the most diversified hedging instrument possible. Other than a BTC dominance hedge, xBTC places itself as the world’s first tokenized derivative as it insures against the price movements, increases exposure to price movements for speculation, and provides access to otherwise hard to trade assets. As it uses rebasing of supply to maintain its peg with BMCD, increases in supply will be a primary benefit to users apart from the incentives received for providing liquidity and building the ecosystem. The token economics is designed in such a way that it ensures incentives and rewards to all network participants for the long term. Looking at the core team working behind the project, coupled with the renowned investors and advisors, xBTC appears to have a bright future. Tradedog recommends BUY for xBTC.