Aug 12, 2021

by Sahaj Sharma

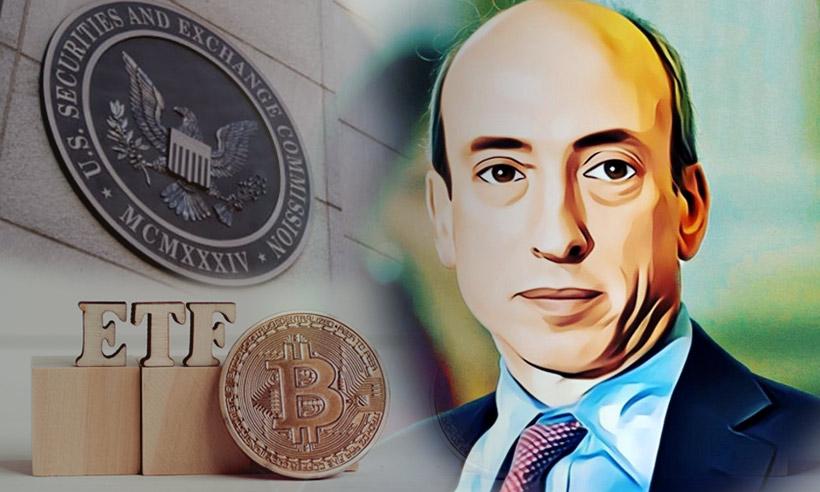

Valkyrie Files for Bitcoin Futures ETF Following Comments from Gary Gensler

.

Disclaimer: The views and opinions expressed in this article are for informational purposes only and do not constitute financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Sahaj is an aspiring journalist with a keen interest in cryptocurrency and the whole concept of Blockchain technology. He is positive about the future potential of Cryptocurrency and Blockchain in shaping the world of finance for good. At present, he is covering the latest developments in the field of the cryptosphere.